Kentucky Farm Tax Exempt Form 2024

BlogKentucky Farm Tax Exempt Form 2024. According to the kentucky dor, if you get a federal extension, you automatically have an extension to file with kentucky. The agriculture exemption number is valid for three years.

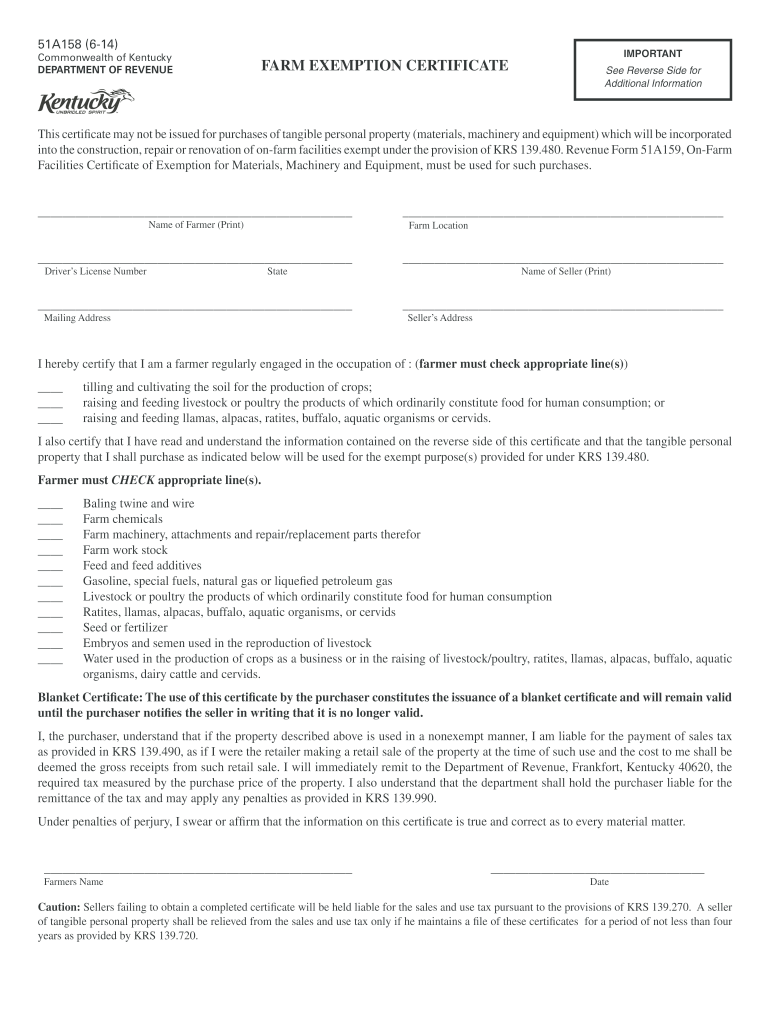

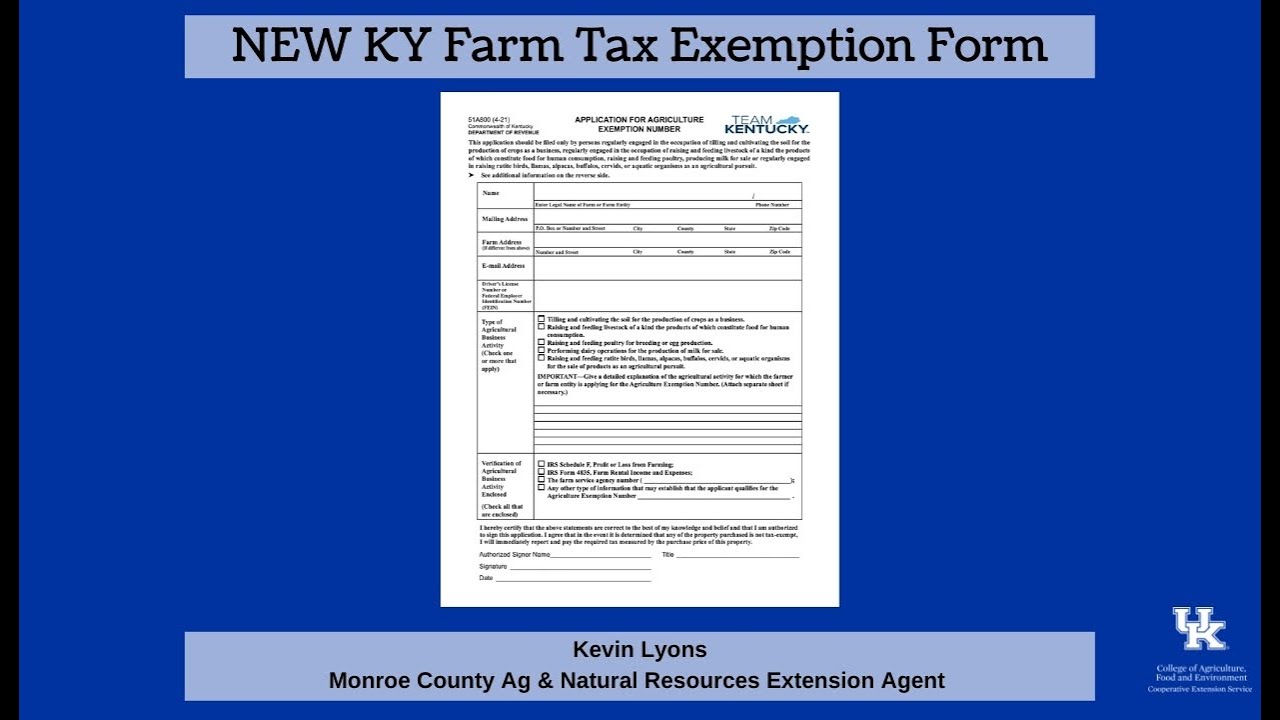

The deadline for applying for the new agriculture exemption number for current farmers is january 1, 2022. Effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases exempt from sales tax.

(updated with senate bill 121 provisions, effective march 30, 2022) why is the agriculture exemption.

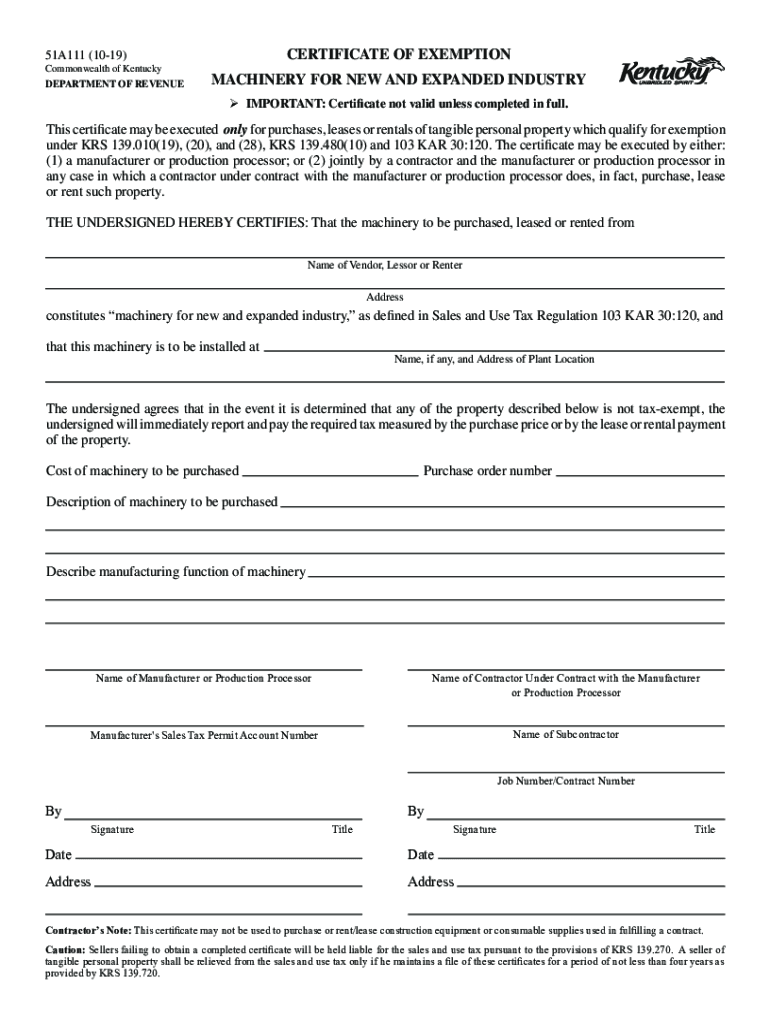

Farm tax exempt form ky Fill out & sign online DocHub, Tax type tax year (select) current 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000. The deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022.

Kentucky farm tax exempt form 2023 Fill out & sign online DocHub, (updated with senate bill 121 provisions, effective march 30, 2022) why is the agriculture exemption. Legislation is now in effect that.

Kentucky tax exempt form Fill out & sign online DocHub, (march 3, 2022) — the kentucky department of revenue (dor) is now accepting applications from eligible farmers for new agriculture exemption numbers. The form has questions pertaining to the customer’s name, farm location, and farming enterprises.

Tax exempt form kentucky Fill out & sign online DocHub, (updated with senate bill 121 provisions, effective march 30, 2022) why is the agriculture exemption. Krs 139.481 requires that farmers who are eligible for agriculture exemptions from sales and use tax apply for and use their agriculture exemption (ae) number on the certificates.

NEW KY Farm Tax Exemption Forms YouTube, Payment of sales and use tax to the vendor. According to the kentucky dor, if you get a federal extension, you automatically have an extension to file with kentucky.

Kentucky Tax 20202024 Form Fill Out and Sign Printable PDF Template, A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Tax type tax year (select) current 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000.

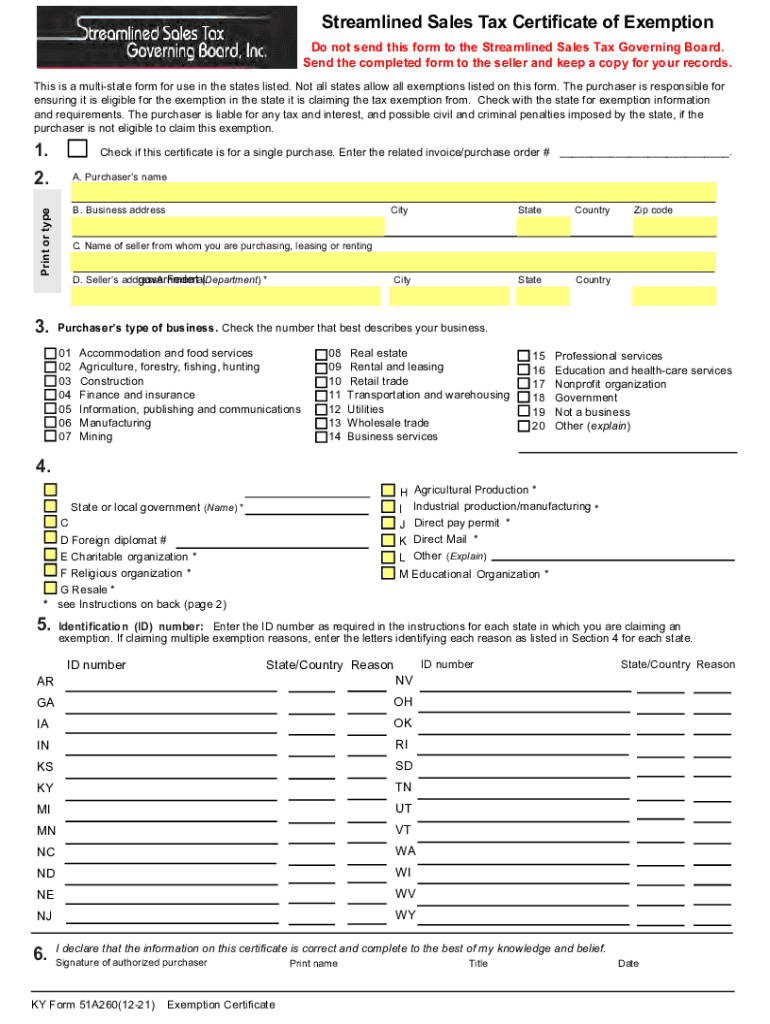

20212024 Form KY 51A260 Fill Online, Printable, Fillable, Blank, The form has questions pertaining to the customer’s name, farm location, and farming enterprises. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax.

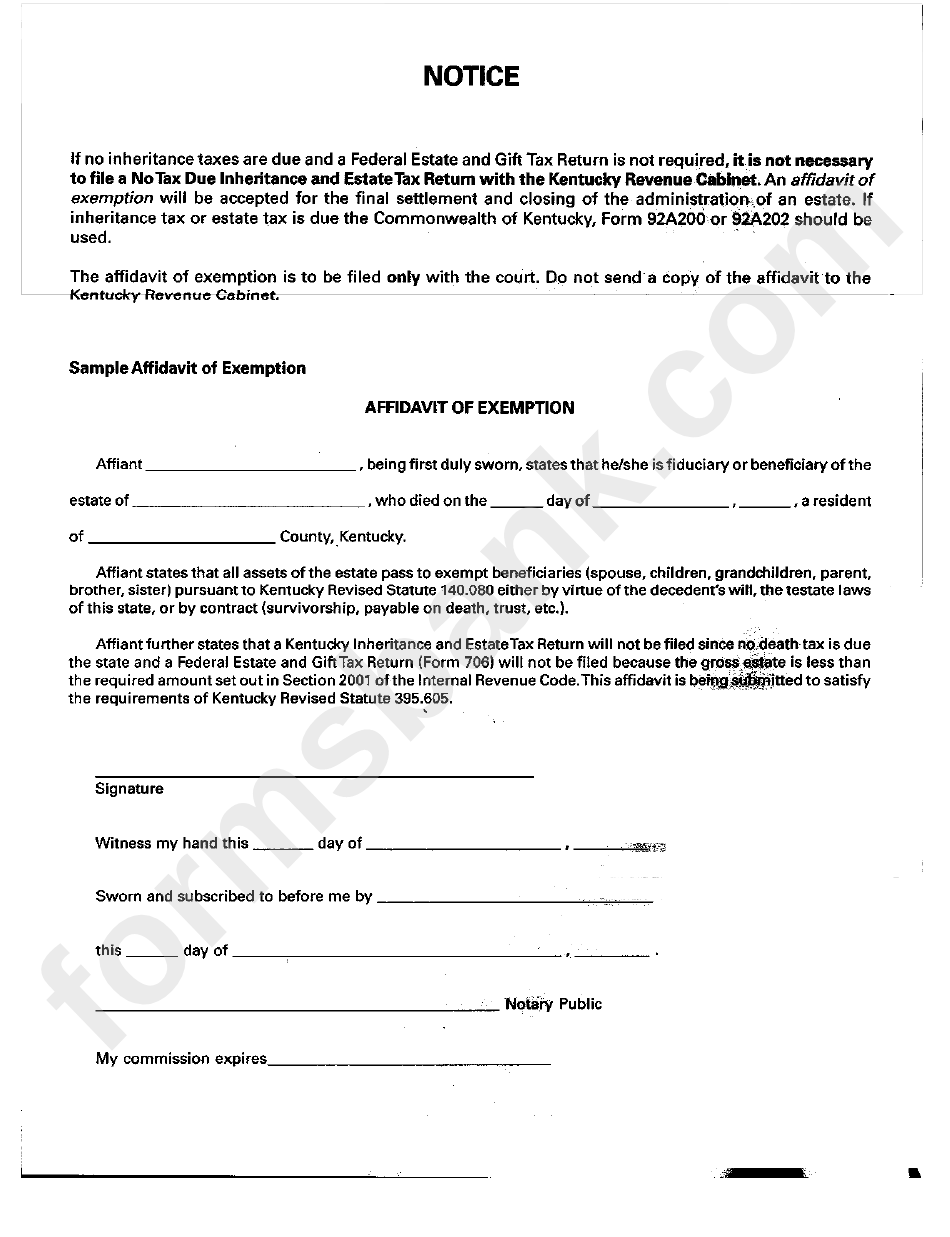

Affidavit Of Exemption Kentucky Tax Exemption Printable Pdf Download, The deadline to apply for the new agriculture exemption number for current farmers is january 1, 2022. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax.

Tax exemption form Fill out & sign online DocHub, (august 5, 2021) — the department of revenue (dor) is now issuing agriculture exemption numbers to all qualified applicants. The form has questions pertaining to the customer’s name, farm location, and farming enterprises.

Tax exempt form pdf Fill out & sign online DocHub, The agriculture exemption number is valid for three years. Legislation is now in effect that.