Business Mileage Rate 2025 Uk

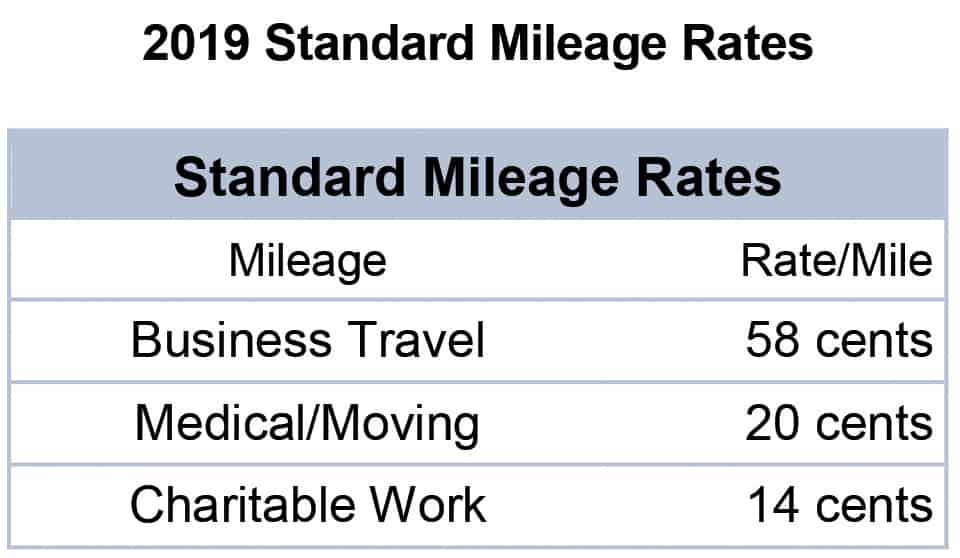

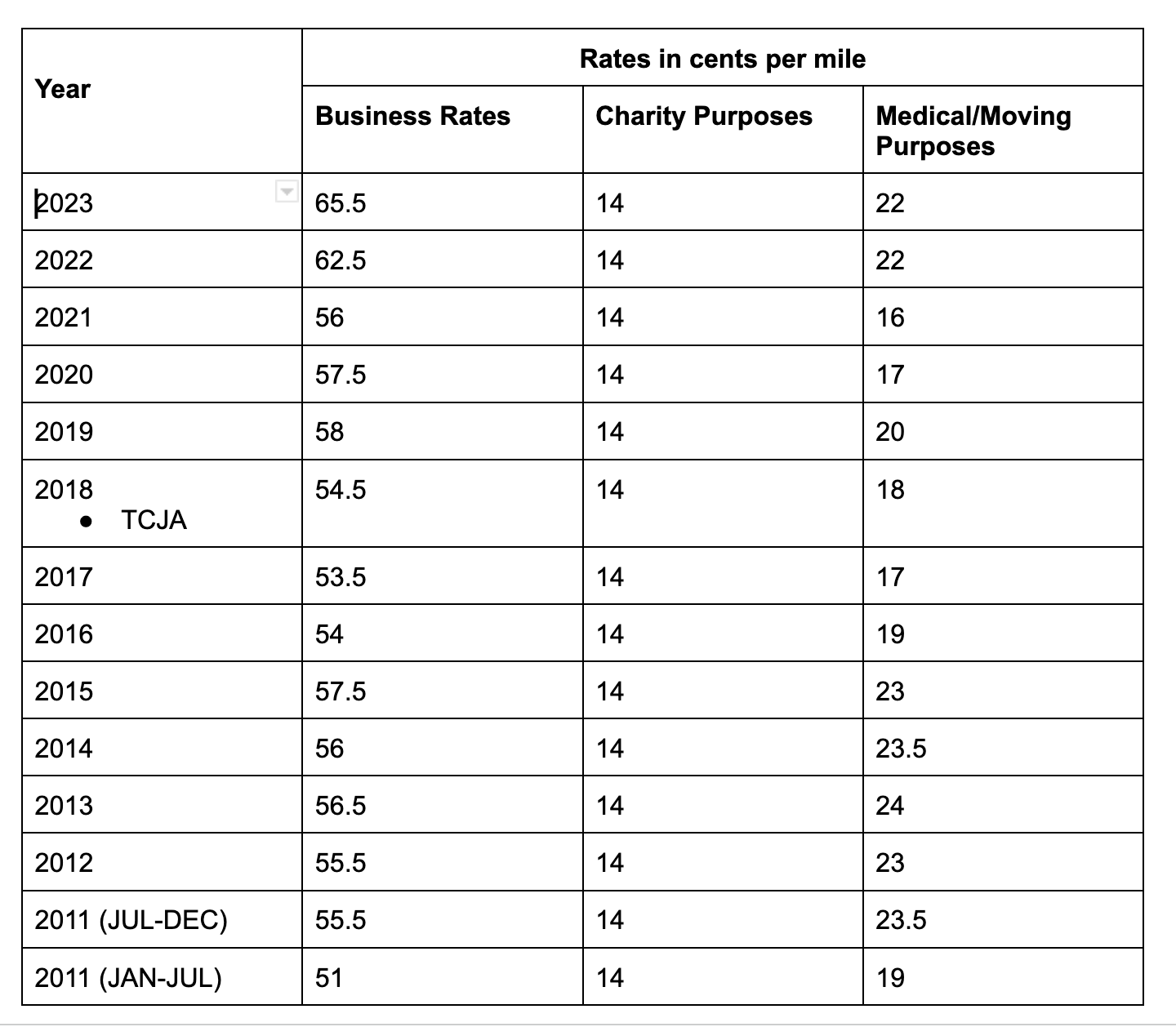

BlogBusiness Mileage Rate 2025 Uk. It is currently set at 45p per mile for the first 10000 miles. The approved mileage allowance payments (amap) rate applies to employees who use their personal electric vehicles for work.

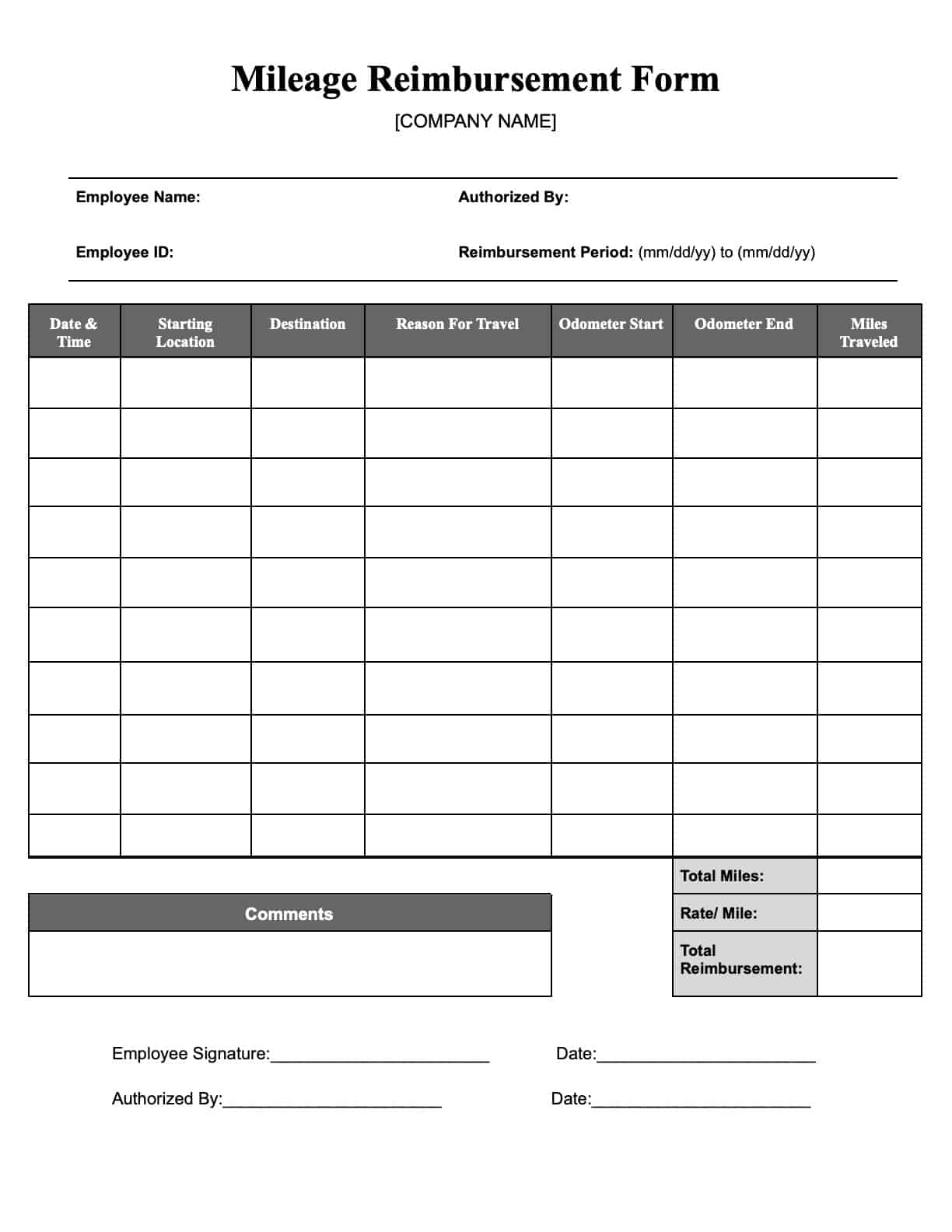

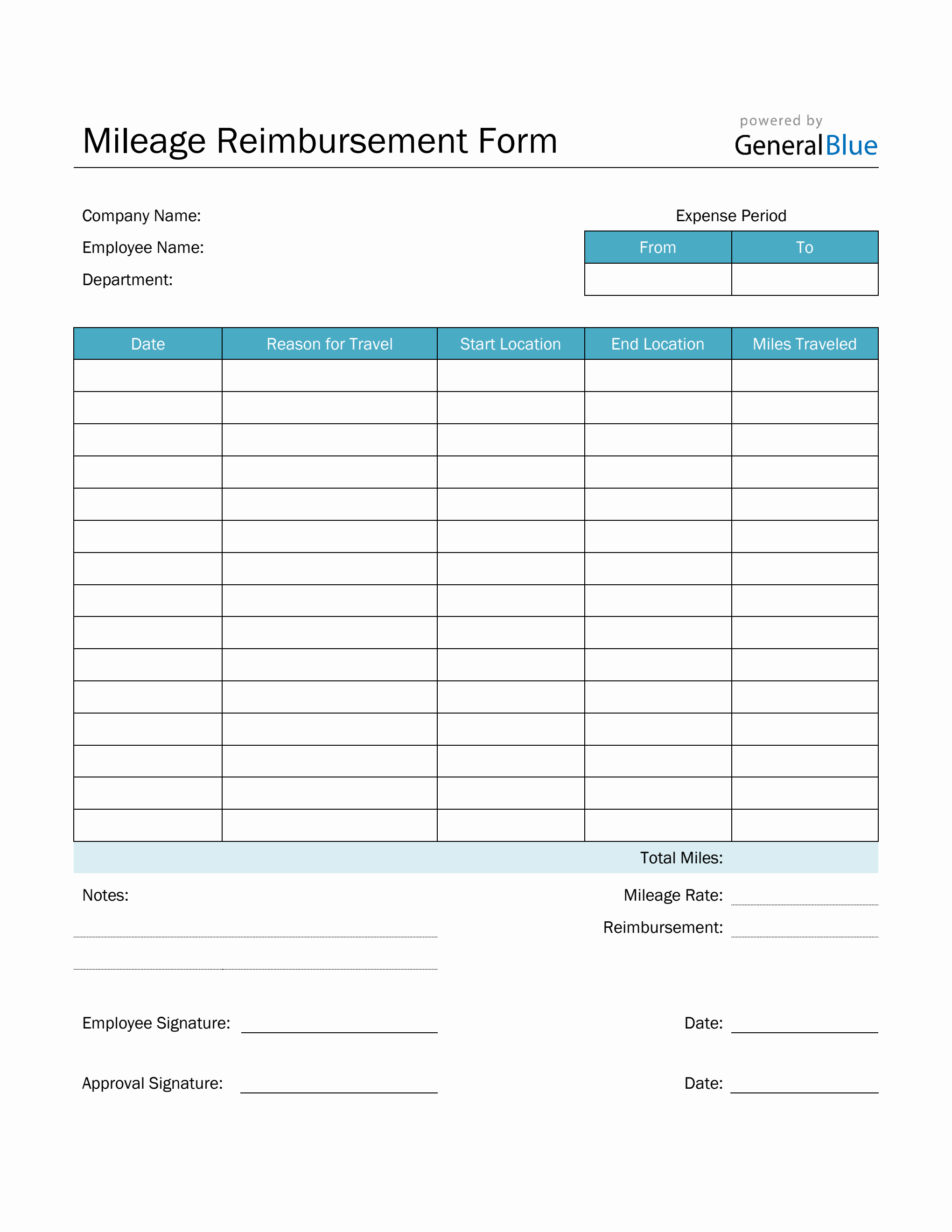

Increase in business mileage rate: To calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their vehicle.

What Is The Mileage Rate For 2025 Uk Dena Morena, Use our free 2025 mileage reimbursement calculator to claim back your business mile expenses.

What Is Business Mileage Rate For 2025 Lorna Rebecca, This letter confirms the business rates multipliers for 2025/2025 and clarifies billing arrangements for the small business multiplier threshold, transitional relief inflation.

Government Mileage Rate 2025 Uk Gladi Kaitlyn, In this blog, we will help you to understand the rules of hmrc mileage allowance and provide you with the latest 2025 hmrc mileage rates for business.

Business Mileage Rate 2025 Jodi Leanna, This is covered in travelperk's short guide to mileage allowance in the uk.

Current Irs Mileage Rate 2025 Announcement Fayre Jenilee, Hybrid cars are treated as either petrol or diesel cars for advisory fuel.

Mileage Rate 2025 Irs Gabbi Kailey, This is covered in travelperk's short guide to mileage allowance in the uk.

Employee Mileage Reimbursement 2025 Uk Nance Valenka, What the 2025 hmrc mileage rates and what journeys can employees claim?

Travel Hiking WordPress Theme By WP Elemento